In the vast landscape of India’s banking industry, numerous career paths beckon those with a passion for finance. This guide is your gateway to understanding the intricacies of the top banking jobs in India.

We will delve deeply into each role, examining their responsibilities, advantages, and disadvantages.

Whether you’re an aspiring finance professional or considering a career switch, this comprehensive article will equip you with the knowledge to make an informed decision about your future in banking.

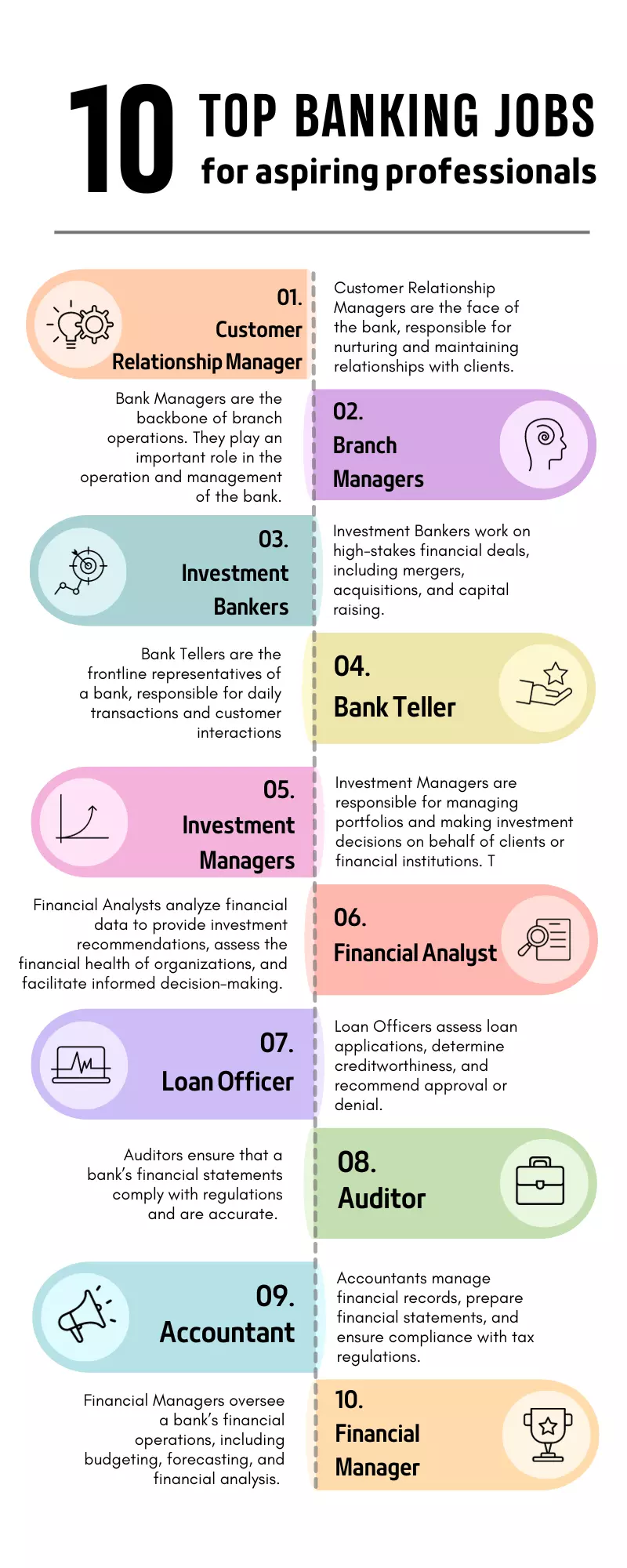

Top Banking Jobs in India

These are the top banking jobs that are rewarding and offers tremendous growth:

1. Customer Relationship Management (CRM)

Customer Relationship Managers play a pivotal role in the banking sector. They are the face of the bank, responsible for nurturing and maintaining relationships with clients. Their primary responsibilities include:

Client Engagement: CRM professionals engage with clients to understand their financial needs and goals. This involves active listening and empathetic communication.

Problem Resolution: When clients encounter issues or have questions, CRMs step in to resolve problems and provide timely solutions.

Sales and Cross-selling: Banks rely on CRMs to promote various banking products and services, including loans, credit cards, and investment options.

Pros:

- Interpersonal Skills: Working as a CRM enhances your communication and interpersonal skills, crucial in any career.

- Customer Interaction: The role involves daily interaction with diverse clients, providing valuable exposure to different perspectives and challenges.

- Career Growth: Successful CRMs can advance to higher positions within the bank.

Cons:

- Pressure: Meeting sales targets and client expectations can be demanding and stressful.

- Dealing with Irate Customers: Not all interactions will be pleasant, and CRMs must remain calm and professional, even when dealing with frustrated clients.

- Sales Targets: Achieving sales targets can sometimes lead to aggressive sales tactics.

2. Branch Managers

Bank Managers are the backbone of branch operations. They play an important role in the operation and management of the bank.

They hold significant responsibilities, including:

Branch Oversight: Managing day-to-day branch operations, ensuring efficient service delivery, and maintaining security standards.

Staff Management: Recruiting, training, and supervising branch staff to ensure productivity and customer satisfaction.

Financial Performance: Ensuring the branch meets financial goals, including revenue, profitability, and cost control.

Pros:

- Leadership Opportunities: Bank Managers lead their teams and play a pivotal role in shaping the branch’s success.

- Competitive Salary: This position often comes with a competitive salary and benefits package.

- Decision-making Authority: Bank Managers make critical decisions that impact the branch’s performance and customer satisfaction.

Cons:

- Heavy Workload: The role can be demanding, requiring long hours and multitasking.

- Demanding Responsibilities: Managers face pressure to meet targets and adhere to bank policies and procedures.

- Long Working Hours: Branch managers often work beyond regular banking hours to ensure smooth operations.

3. Investment Banking

Investment Bankers work on high-stakes financial deals, including mergers, acquisitions, and capital raising. Their responsibilities include:

Financial Analysis: Conducting extensive financial analysis to evaluate investment opportunities and risks.

Client Advisory: Providing strategic advice to corporate clients, including valuation, negotiation strategies, and financial structuring.

Deal Execution: Overseeing the execution of complex financial transactions, such as IPOs and bond issuances.

Pros:

- Lucrative Compensation: Investment banking is renowned for its high earning potential, including substantial bonuses.

- High-profile Deals: Exposure to prestigious and high-value transactions can boost your career.

- Career Progression: Successful investment bankers often advance to top positions in finance.

Cons:

- Intense Work Hours: Investment bankers are notorious for long working hours, often exceeding 80 hours a week during peak deal times.

- High Stress Levels: The pressure to meet tight deadlines and deliver flawless results can be mentally and emotionally taxing.

- Demanding Clients: Dealing with demanding clients and high expectations can be challenging.

4. Bank Teller

Bank Tellers are the frontline representatives of a bank, responsible for daily transactions and customer interactions, including:

Transaction Processing: Handling customer deposits, withdrawals, check cashing, and other financial transactions.

Customer Assistance: Providing information about bank products and services and assisting with account inquiries.

Cash Management: Ensuring cash drawers are balanced and maintaining adequate cash reserves.

They can ask customers about their transactions to ensure the compliance and terms of the bank. Bank tellers often ask questions that can frustrate the customer but that’s the way they’re. They can ask reason for the withdrawal of the money or anything if they feel is violation the guidelines.

Pros:

- Entry-level Position: Bank teller positions are often open to candidates with minimal banking experience.

- Learning Opportunities: Working as a teller provides a foundation for understanding banking operations.

- Customer Service Experience: Regular customer interactions develop strong customer service skills.

Cons:

- Monotonous Tasks: The role can become repetitive, with a focus on routine transactions.

- Low Starting Salary: Entry-level salaries for tellers may be modest compared to other banking roles.

- Limited Growth Prospects: Advancement opportunities may be limited within the teller role.

5. Investment Management

Investment Managers are responsible for managing portfolios and making investment decisions on behalf of clients or financial institutions.

It is one of the lucrative jobs that’s the reason it is the most sought after and aspiring jobs for individuals.

But sometimes people loose hope because getting into investment manager requires multifaceted skill set along with a relevant academic degree.

But this is not the case. Anyone can become an investment manager without a degree, what they need is just dedication and commitment to stay honest to their goals.

Their duties include:

Portfolio Management: Constructing and managing investment portfolios to achieve client objectives.

Market Research: Conducting extensive market research to identify investment opportunities and risks.

Client Communication: Regularly communicating with clients to discuss investment strategies and performance.

Pros:

- High Earnings Potential: Successful investment managers can earn substantial fees and bonuses.

- Intellectual Stimulation: Analyzing financial markets and making investment decisions is intellectually rewarding.

- Fund Management: The role offers the opportunity to manage significant funds.

Cons:

- Market Volatility: The financial markets can be highly volatile, impacting the performance of investment portfolios.

- Regulatory Requirements: Investment managers must adhere to stringent regulatory guidelines.

- Performance Pressure: The pressure to deliver positive returns for clients can be intense.

6. Financial Analyst

Financial Analysts analyze financial data to provide investment recommendations, assess the financial health of organizations, and facilitate informed decision-making. Their responsibilities include:

Financial Modeling: Creating detailed financial models to evaluate investment opportunities and risks.

Report Generation: Preparing financial reports and presentations for internal and external stakeholders.

Market Research: Analyzing economic and market trends to inform investment strategies.

Pros:

- Analytical Skill Development: Financial analysts hone their analytical skills, which are valuable in various industries.

- Competitive Pay: The role offers competitive salaries and potential for bonuses.

- Diverse Industry Opportunities: Financial analysts can work in diverse industries, including finance, consulting, and corporate finance.

Cons:

- Long Hours: Analysts often work long hours, especially during peak reporting periods.

- Intense Competition: The field is highly competitive, with a significant number of qualified professionals vying for positions.

- Continuous Learning Curve: Staying updated with financial regulations and market trends requires ongoing education and training.

7. Loan Officer

Loan Officers assess loan applications, determine creditworthiness, and recommend approval or denial. Their responsibilities encompass:

Client Interviews: Interviewing loan applicants to gather financial information and assess their ability to repay loans.

Risk Assessment: Evaluating credit risk and making lending decisions in accordance with bank policies.

Loan Documentation: Preparing loan documents and ensuring compliance with regulations.

Pros:

- Commission-based Earnings: Loan officers often earn commissions for each approved loan, potentially leading to higher earnings.

- Job Stability: There is a consistent demand for loan officers, ensuring job stability.

- Helping Individuals: Loan officers play a crucial role in helping individuals and businesses secure financing for their goals.

Cons:

- Pressure to Meet Targets: Loan officers may face pressure to meet lending targets, which can be challenging.

- Dealing with Rejected Applications: Rejecting loan applications can be emotionally challenging for loan officers.

- Regulatory Constraints: Loan officers must adhere to strict lending regulations.

8. Analyst

Analysts gather and analyze financial data to support investment decisions or risk management strategies. Their responsibilities include:

Data Analysis: Collecting and analyzing financial data to identify trends and patterns.

Risk Assessment: Evaluating investment risks and providing recommendations to mitigate them.

Reporting: Preparing detailed reports and presentations for stakeholders.

Pros:

- Broad Exposure to Financial Markets: Analysts gain exposure to various financial markets and investment instruments.

- Career Growth Potential: Successful analysts can advance to higher positions in finance, including portfolio management and research.

- Analytical Skill Development: The role enhances analytical and critical thinking skills.

Cons:

- Intense Competition: The field is competitive, with many professionals vying for positions at top firms.

- Data-intensive Work: Analysts spend significant time working with data and financial models.

- Market Uncertainty: Analysts must navigate market volatility and uncertainty, which can be challenging.

9. Auditor

Auditors ensure that a bank’s financial statements comply with regulations and are accurate. Getting a career in Auditor requires academic qualifications and set of skills, however anyone can become an auditor even without a degree.

Well, the responsibilities of the auditor are:

Financial Statement Review: Examining financial statements and records to ensure accuracy and compliance.

Internal Controls: Assessing the effectiveness of internal controls to prevent financial irregularities.

Report Generation: Preparing audit reports and recommendations for improvements.

Pros:

- High Demand for Auditing Skills: Skilled auditors are in demand across various industries.

- Job Security: Auditing is a critical function for regulatory compliance, ensuring job security.

- Exposure to Bank Operations: Auditors gain insights into bank operations and financial management.

Cons:

- Extensive Documentation: Auditors must maintain detailed records and documentation.

- Tight Deadlines: Auditors often work under tight deadlines to complete audits.

- Repetitive Tasks: Some aspects of auditing can become routine.

10. Credit Analysts

Credit analysts are financial professionals responsible for assessing the creditworthiness of individuals, businesses, or organizations.

Their primary role is to evaluate the risk associated with lending money or extending credit to borrowers.

Credit analysts work in various financial institutions, including banks, credit unions, and investment firms.

Their responsibilities and the pros and cons of the job are as follows:

Responsibilities:

- Financial Analysis: Credit analysts conduct in-depth financial analysis to determine a borrower’s ability to repay loans or credit. They examine financial statements, income statements, and credit reports to assess the borrower’s financial health.

- Risk Assessment: They evaluate the risk associated with each credit application, considering factors like credit history, collateral, and economic conditions. This assessment helps the lending institution make informed decisions.

- Recommendations: Credit analysts provide recommendations to the institution’s decision-makers. They may recommend approving the credit application as is, approving it with certain conditions, or rejecting it altogether.

- Compliance: They ensure that the lending institution adheres to relevant regulations and guidelines, such as anti-money laundering and know-your-customer (KYC) rules.

- Client Interaction: Credit analysts often interact with borrowers or clients to gather additional information and clarify details related to their credit applications.

Pros:

- Analytical Skills: This role hones your analytical skills as you assess financial data and make crucial lending decisions.

- Job Security: Credit analysts are in demand as financial institutions continually need to assess credit risk, providing job stability.

- Career Growth: Successful credit analysts can advance into roles such as senior credit analyst, underwriter, or risk manager.

- Competitive Salary: Credit analysts typically earn competitive salaries, and their expertise is highly valued in the financial industry.

- Industry Exposure: You gain exposure to various industries and businesses, making it a valuable learning experience.

Cons:

- Heavy Responsibility: Making lending decisions comes with a high level of responsibility, as errors can lead to financial losses for the institution.

- Time-Intensive: The job can be time-intensive, especially when analyzing complex financial portfolios.

- Regulatory Challenges: Keeping up with changing financial regulations and compliance requirements can be demanding.

- Stressful at Times: Dealing with defaulting borrowers and economic downturns can be stressful.

- Limited Creativity: The role is heavily based on financial data and risk assessment, with limited room for creativity.

Career as a credit analyst offers a rewarding opportunity to work in the financial industry, make informed lending decisions, and enjoy job security.

However, it comes with the responsibility of managing financial risks and staying current with evolving financial regulations.

It’s a role that requires strong analytical skills and a keen eye for detail.

11. Accountant

Accountants manage financial records, prepare financial statements, and ensure compliance with tax regulations. Their responsibilities include:

Financial Record Keeping: Maintaining accurate financial records and ledgers.

Tax Compliance: Ensuring the organization complies with tax laws and regulations.

Financial Reporting: Preparing financial statements and reports for stakeholders.

Pros:

- Versatile Career Options: Accountants can work in various industries, including public accounting, corporate finance, and government.

- Stable Job Market: The demand for skilled accountants ensures job stability.

- Potential for Self-Employment: Accountants have the option to start their own practices.

Cons:

- Routine Tasks: Some aspects of accounting involve repetitive tasks, such as data entry and reconciliations.

- Heavy Workload During Tax Season: Tax accountants often experience heavy workloads during tax season.

- Continuous Regulatory Changes: Accountants must stay updated with changing tax laws and regulations.

12. Financial Manager

Financial Managers oversee a bank’s financial operations, including budgeting, forecasting, and financial analysis. Their responsibilities include:

Financial Planning: Creating and implementing financial plans and budgets.

Financial Analysis: Analyzing financial data to assess performance and identify areas for improvement.

Risk Management: Managing financial risks and optimizing the bank’s financial health.

Pros:

- High Earning Potential: Financial Managers often earn competitive salaries and bonuses.

- Strategic Decision-Making: The role involves strategic financial decision-making that impacts the organization’s success.

- Leadership Role: Financial Managers lead financial teams and have a significant role in the bank’s management.

Cons:

- Stressful: The role can be stressful, particularly during periods of financial uncertainty.

- Long Hours: Financial Managers may work long hours to meet financial goals and deadlines.

- Responsibility for Financial Performance: The pressure to ensure financial performance can be intense.

How to Find the Highest Paying Jobs in Major Banks

Securing a high-paying job in a major bank in India can be a rewarding career move. However, competition for these positions is fierce.

Here are some strategies to help you identify and pursue the highest paying jobs in major banks:

1. Research the Job Market

Start by researching the current job market for banking professionals. Look for trends in job demand, salary ranges, and the specific roles that offer the highest compensation packages.

2. Identify Major Banks

Identify the major banks in India, such as HDFC Bank, ICICI Bank, State Bank of India (SBI), Axis Bank, and Kotak Mahindra Bank. These institutions typically offer a wide range of job opportunities, including high-paying roles.

3. Explore Senior Positions

High-paying positions in major banks often include senior roles such as Vice President (VP), Director, or Head of Department. Explore job listings and requirements for these senior positions.

4. Build Relevant Skills and Experience

To qualify for high-paying roles, you’ll need to build relevant skills and experience. Consider pursuing advanced degrees, certifications, or specialized training in areas such as investment banking, risk management, or financial analysis.

5. Network Effectively

Networking is crucial in the banking industry. Attend industry events, join professional associations, and connect with current or former banking professionals who may provide valuable insights and job leads.

6. Utilize Job Search Portals

Job search portals and websites dedicated to banking careers often list high-paying job opportunities in major banks. Keep a close eye on these platforms and set up job alerts to stay informed.

7. Contact Banking Recruiters

Reach out to banking recruiters and staffing agencies specializing in the financial sector. They can help you identify high-paying job openings and guide you through the application process.

8. Monitor Company Websites

Major banks frequently update their career pages with job openings. Regularly check the official websites of these banks for the latest high-paying job listings.

9. Leverage LinkedIn

LinkedIn is a powerful tool for job seekers. Create a strong LinkedIn profile, connect with professionals in the banking industry, and follow major banks to receive updates on job postings.

10. Prepare for Rigorous Interviews

High-paying banking roles often involve rigorous interview processes, including multiple rounds of interviews and assessments. Be prepared to showcase your expertise, experience, and suitability for the position.

11. Consider Relocation

Depending on your career goals, be open to the possibility of relocating to major financial centers where high-paying banking jobs are more prevalent, such as Mumbai, Delhi, or Bangalore.

12. Negotiate Compensation:

When you receive a job offer, don’t hesitate to negotiate your compensation package. Research industry salary benchmarks and be prepared to discuss your expectations with the hiring manager.

Finding the highest paying jobs in major banks in India requires dedication, skill development, and a proactive approach to job hunting.

These strategies and staying informed about the latest job opportunities can increase your chances of securing a lucrative banking career.

Tips for Cracking a Banking Job Interview

Securing a banking job in India often involves a diligent selection process, which typically includes interviews.

These interviews assess not only your qualifications but also your suitability for the banking role. Here are some valuable tips to help you excel in your banking interview:

1. Research the Bank

Start by thoroughly researching the bank you’re interviewing with. Understand its history, mission, values, and recent developments. This knowledge demonstrates your genuine interest and commitment.

2. Know the Job Role

Familiarize yourself with the specific job role you’re applying for. Be prepared to discuss the responsibilities, skills required, and how your background aligns with the position.

3. Brush Up on Banking Knowledge

Banking interviews often include questions about financial markets, banking regulations, and industry trends. Stay up-to-date with current events and financial news to answer these questions confidently.

4. Highlight Your Skills

Prepare examples that showcase your relevant skills. Whether it’s customer service, financial analysis, or risk management, use real-life situations to demonstrate your capabilities.

5. Behavioral Questions

Be ready to answer behavioral questions that assess your problem-solving abilities, teamwork, and adaptability. Use the STAR (Situation, Task, Action, Result) method to structure your responses.

6. Quantitative and Technical Proficiency

Depending on the role, you might face technical questions or quantitative assessments. Review relevant concepts and practice numerical problems to ensure you’re well-prepared.

7. Communication Skills

Clear and effective communication is crucial in banking. Practice articulating your thoughts concisely and confidently, as interviewers will assess your ability to interact with clients and colleagues.

8. Dress Professionally

Dressing professionally and in accordance with the bank’s dress code is essential. Choose conservative attire that conveys professionalism and confidence.

9. Ask Questions

Prepare thoughtful questions to ask the interviewers. This demonstrates your genuine interest and engagement in the role and the organization.

10. Prepare for Common Questions

Expect common interview questions such as “Tell me about yourself,” “Why do you want to work in banking?” and “What are your strengths and weaknesses?” Craft well-thought-out responses in advance.

11. Mock Interviews

Conduct mock interviews with a friend or mentor to gain practice and receive constructive feedback. This can boost your confidence and help refine your responses.

12. Stay Calm and Confident

During the interview, remain calm and composed. Confidence in your abilities and preparation will make a positive impression.

13. Follow Up

After the interview, send a thank-you email to the interviewers. Express your gratitude for the opportunity and reiterate your interest in the position.

By incorporating these interview tips into your preparation, you’ll be well-equipped to showcase your skills and secure that coveted banking job in India.

Final Words

Selecting the right banking career path in India is a significant decision that will shape your professional journey.

Each of the roles discussed in this article offers distinct opportunities and challenges.

As you make your decision, consider your skills, interests, and long-term career goals. The banking sector in India continues to evolve, presenting new avenues for ambitious professionals.

Best of luck as you embark on your journey toward a rewarding and fulfilling banking career!

FAQs for Top Banking Jobs in India

The most sought-after banking jobs in India include Customer Relationship Management (CRM), Management, Investment Banking, Bank Teller, Investment Management, Financial Analyst, Loan Officer, Analyst, Auditor, RBI Assistant, Accountant, Financial Manager, and Branch Manager.

Educational qualifications vary by role, but many banking positions require a bachelor’s degree in finance, business, economics, or a related field. Some roles may require specific certifications or postgraduate degrees for advancement.

The salary range for banking professionals in India can vary widely based on factors like experience, location, and the specific role.

Pros of investment banking include lucrative compensation, exposure to high-profile deals, and potential career progression. Cons may include intense work hours, high stress levels, and demanding clients.

To prepare for a banking interview in India, research the bank, understand the role, brush up on banking knowledge, practice answering common interview questions, and be ready to discuss your skills and experiences. Conduct mock interviews and stay calm and confident during the actual interview.

Yes, there are ample opportunities for career growth in the Indian banking sector. Many professionals start in entry-level positions and progress to managerial and leadership roles as they gain experience and expertise.

Emerging trends in the Indian banking industry include digital banking innovations, the use of artificial intelligence and data analytics, increased focus on customer-centric services, and sustainable banking practices.

Effective networking in the banking industry involves attending industry events and conferences, joining professional associations, connecting with professionals on LinkedIn, and actively seeking mentorship opportunities.

Key regulatory considerations include adherence to banking regulations set by the Reserve Bank of India (RBI) and compliance with anti-money laundering (AML) and know your customer (KYC) regulations.

Staying updated with industry trends can be done by following reputable financial news sources, subscribing to industry publications, and participating in relevant webinars and seminars.